san francisco gross receipts tax estimated payments

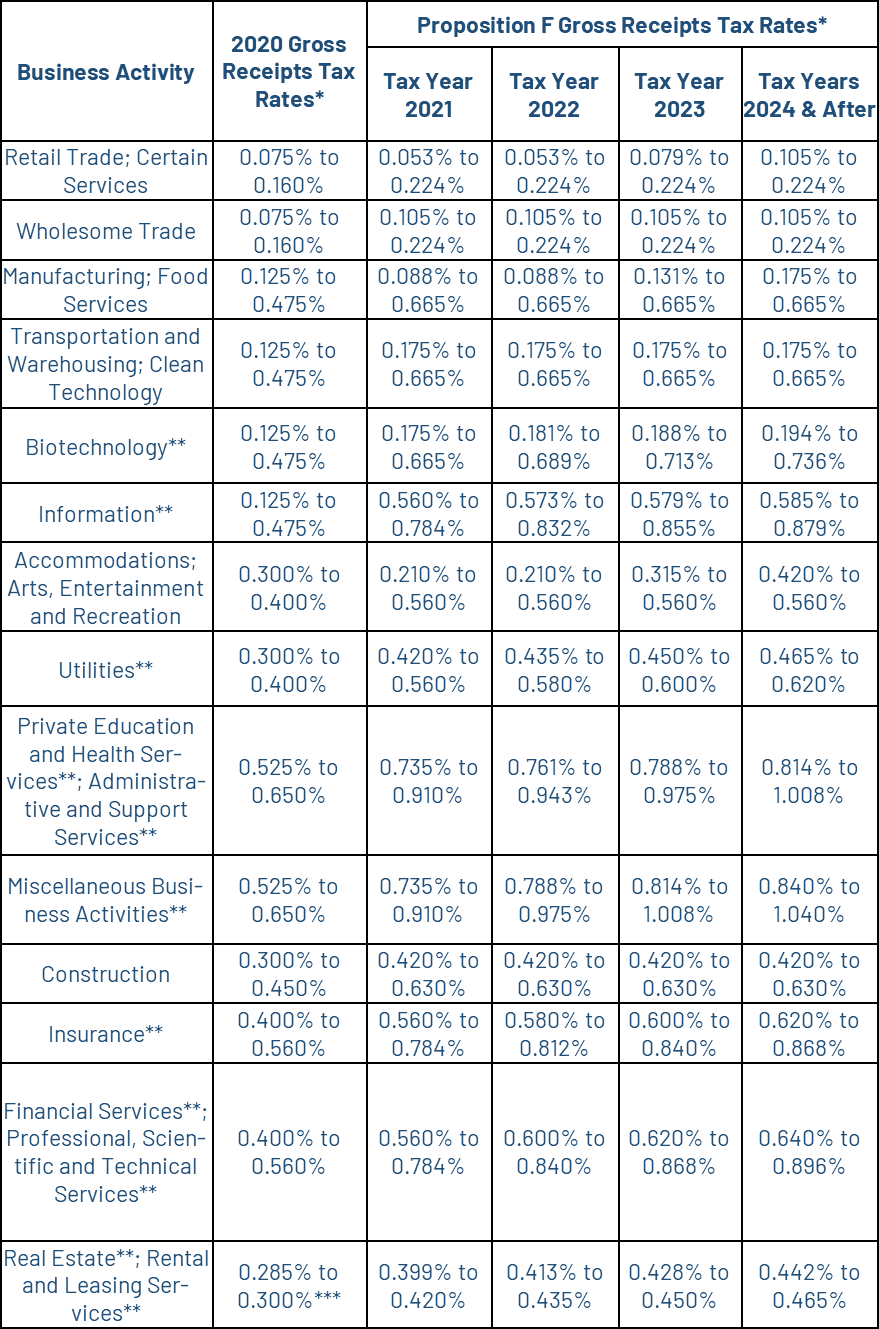

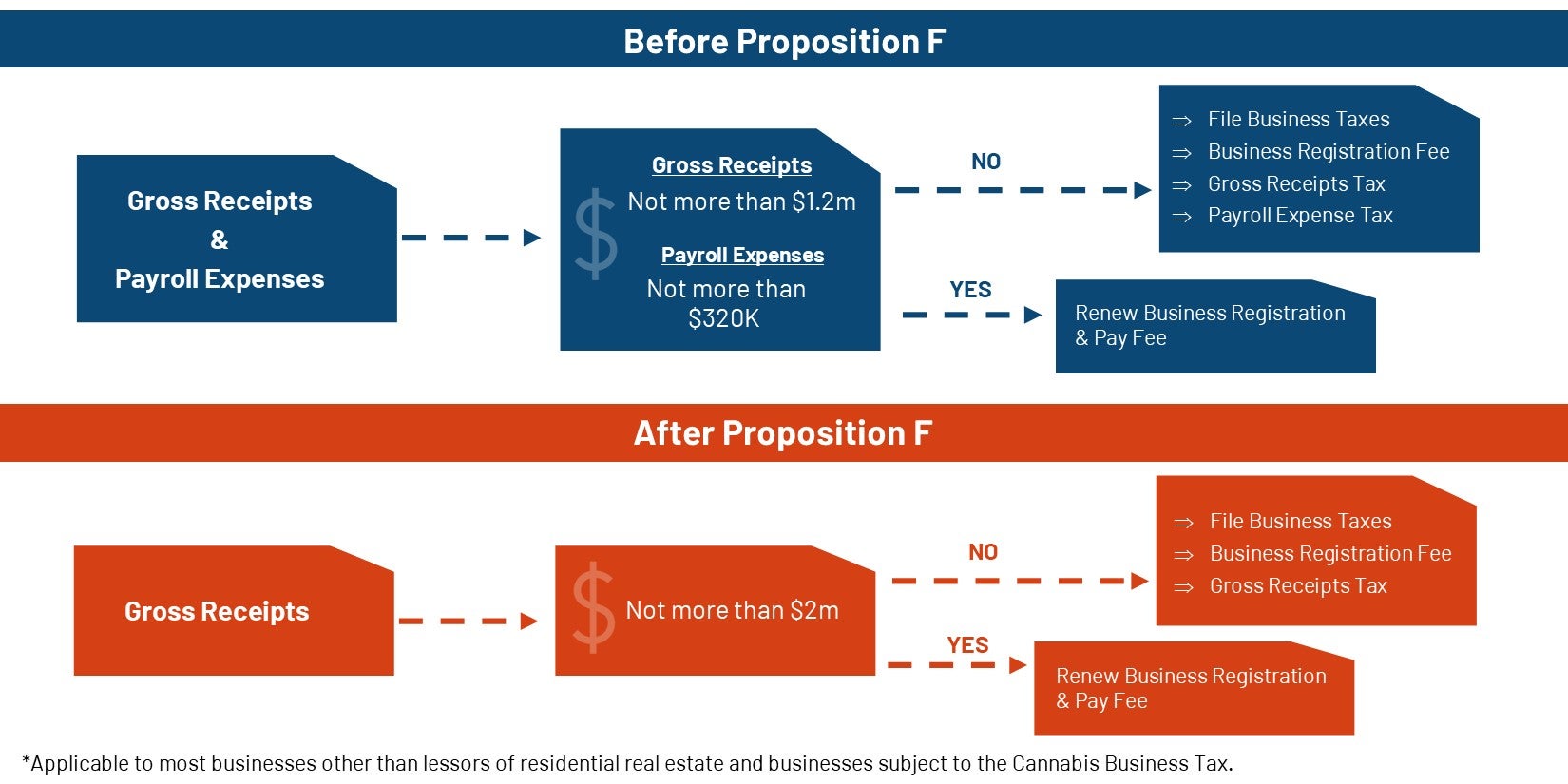

Enter Your Status Income Deductions And Credits And Estimate Your Total Taxes. Measure E will phase out the citys current payroll tax over a period of five years and replace it with a gross receipts tax.

Secured Property Taxes Treasurer Tax Collector

1 San Francisco previously levied a.

. Estimated tax payments due dates include April 30th August 2nd and November 1st. For a business engaged in business within San Francisco as an administrative office the tax rate is a percentage of the businesss total payroll expense attributable to San Francisco for the tax year ranging from. Lean more on how to submit these installments online to comply with the Citys business and tax regulation.

The Business Tax and Fee Payment Portal provides a summary of unpaid tax license and fee obligations. Use this TTX worksheet to help calculate your gross receipts tax for tax planning and installment payment purposes. You may pay online through this portal or you may.

HRGT imposed additional business taxes to create a dedicated fund to support services for homeless people and prevent homelessness including one tax of 0175 to 069 on gross receipts over 50 million that a business receives in San Francisco and another tax of 15 on certain administrative offices payroll expense in San Francisco. Payroll Expense Tax Until 2018 all businesses with a taxable San Francisco payroll expense greater than 150000 must file a Payroll Expense Tax Statement for their business annually by the last day of February for the prior calendar year Jan. San Francisco Online Bill Payment.

If the proposed tax was adopted these businesses would pay 67 of total business tax revenue. For registration years after June 30 2015 annual fees are determined by gross receipts from the prior year and fees can range from 90 to a maximum of 35000 for companies with gross receipts over 200M in the prior year. The Treasurer and Tax Collectors office of the City of San Francisco announced that quarterly estimated tax payments of the Gross Receipts Tax Payroll Expense Tax Commercial Rents Tax and Homelessness Gross Receipts Tax that would otherwise be due on April 30 2020 are waived for taxpayers or combined groups that had combined San Francisco.

Businesses will pay the payroll tax for the last time in 2017 and begin paying only the gross receipts tax in its place in 2018. Dont just learn what excise tax is find out how Avalara can help you manage it. Ad Find out what excise tax applies to and how to manage compliance with Avalara.

Account for 3 of Gross Receipts tax payers pay 57 of all business tax revenue including the Gross Receipts tax Payroll Expense tax and Administrative Office Tax. Business Tax and Fee Payment Portal. Anatomy Of San Francisco Now Fewer People Jobs Tourists Businesses But More Spending By The Hangers On But That Was Inflation Wolf Street.

It is estimated that this will result in 285 million more a year in revenue to the city. San Francisco Gross Receipts Tax. San Francisco S Biggest Companies Now Forced To Pay A Homeless Tax.

Welcome to the San Francisco Office of the Treasurer Tax Collectors Business Tax and Fee Payment Portal. Friday February 18 2022. Due Dates for Quarterly Installment Payments.

Article 33 specifies that the San Francisco tax collector has the discretion to determine a businesss gross receipts within San Francisco. San francisco gross receipts tax estimated payments. Pay online the Payroll Expense Tax and Gross Receipts Tax quarterly installments.

Ad Estimate Your Taxes And Refunds Easily With This Free Tax Calculator From AARP. Important filing deadlines include the San Francisco Gross Receipts filing deadline of February 28 and the April 1st business property tax filing. The focus of the proposed tax on a small percentage of all businesses.

In 2022 San Francisco has many unique corporate tax deadlines beyond the traditional April 15th tax return date. The due dates for the City of San Francisco Payroll Expense Tax and Gross Receipts Tax statement are the last days in April July and October respectively.

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

Image On Hloom Com Http Www Hloom Com Free Excel Invoice Templates Invoice Template Word Freelance Invoice Template Invoice Template

Property Management Invoice Download At Http Www Excelinvoicetemplates Com Property Ma Invoice Template Invoice Template Word Microsoft Word Invoice Template

San Francisco Gross Receipts Tax

Public School Teacher Salary Comparably

Secured Property Taxes Treasurer Tax Collector

Prop F 2020 Business Tax Overhaul Treasurer Tax Collector

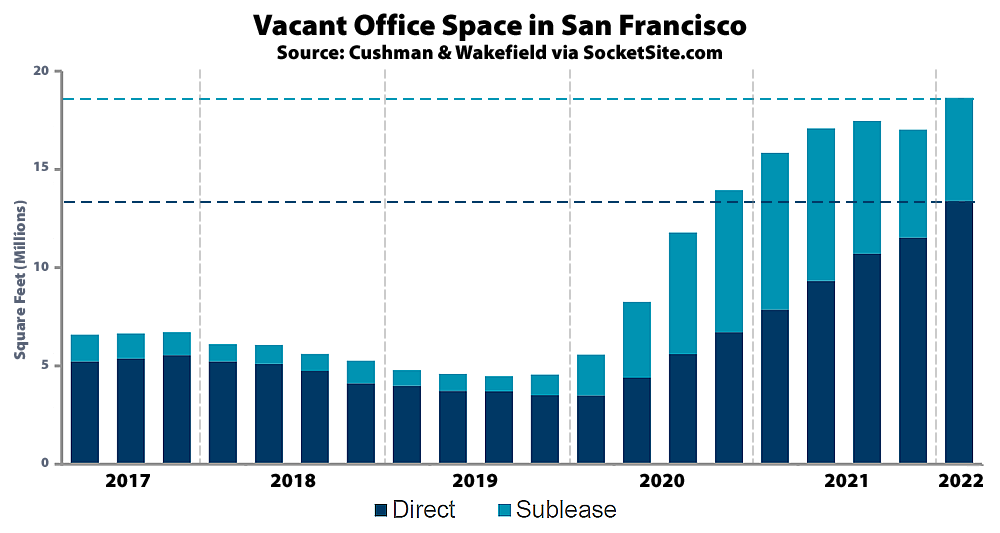

Office Vacancy Rate In San Francisco Hits A Pandemic High

Different Types Of Payroll Deductions Gusto

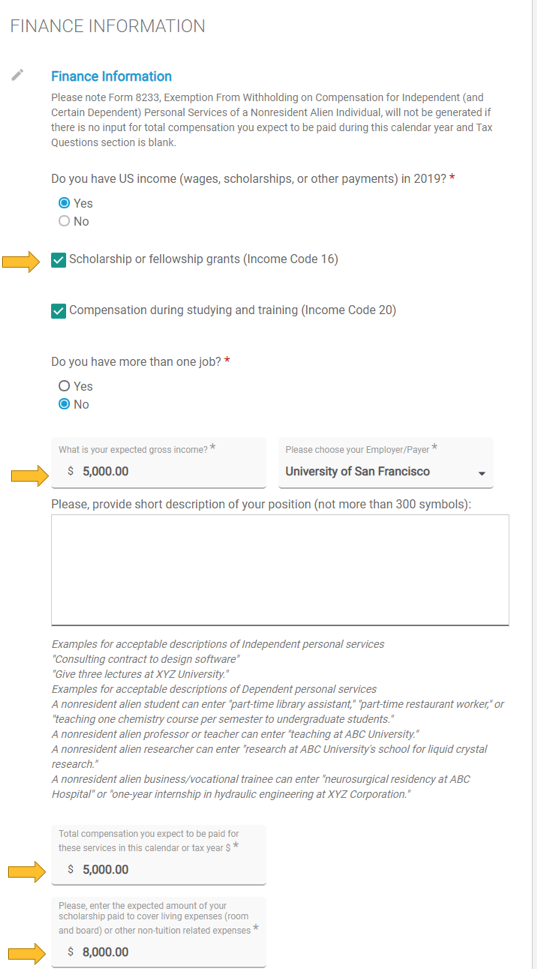

Internal Audit Sprintax Tds Myusf

Secured Property Taxes Treasurer Tax Collector

Gross Receipts Tax And Payroll Expense Tax Sfgov

San Francisco S Overpaid Ceo Tax Measure Targets Disparity Calmatters